idaho education tax credit 2021

Grocery Credit - 100 per exemption An additional 20 may be claimed if you are over age 65 and a resident of the state. Educational Contribution Credit - limited to the smallest of one-half donated.

First Time Home Buyer Savings Accounts Idaho Realtors

The employer tax credit is capped at 500 per employee per year.

. If you itemize your taxes a donation to North Star allows income tax deductions on your state and federal returns plus a 50 Idaho income tax credit. Qualified withdrawals from a 529 account can be used toward 1. Current Book Review 2021 Archives.

These back taxes forms can not longer be e-Filed. January 19 2021 Agenda Minutes February 16 2021 Agenda Minutes March 16 2021 Agenda. 20 tax credit for Idaho employers of up to 500 per employee per year for contributions made to the employees IDeal account 4.

The college entrance exam requirement has been waived for students graduating during the 2021-2022 school year including summer 2022 term. Investment Tax Credit 2021 Qualifying Depreciable Property Idaho generally follows the definition of qualified property found in the Internal Revenue Code IRC sections 46 and 48 as in effect before 1986. Gifts to North Star Charter may qualify for a 50 tax credit a reduction in the actual tax you owe.

Idaho State Income Tax Forms for Tax Year 2021 Jan. E911 - Prepaid Wireless Fee. Take a minimum of 46 high school credits which include 29.

2021 Readers Choice. Amends Title 33 Chapter 9 Idaho Code By Adding A New Section. This credit is available regardless of whether or not you itemize deductions.

IREC accepts many but not all courses taken in other jurisdictions and some courses offered for other professions. Listed below are the credits that are available to you on your Idaho return. January 26 2022 By Cascade Library Staff.

IT Help Desk. Make a gift today and earn your Idaho Tax Credit this year while creating a significant impact at Bishop Kelly. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

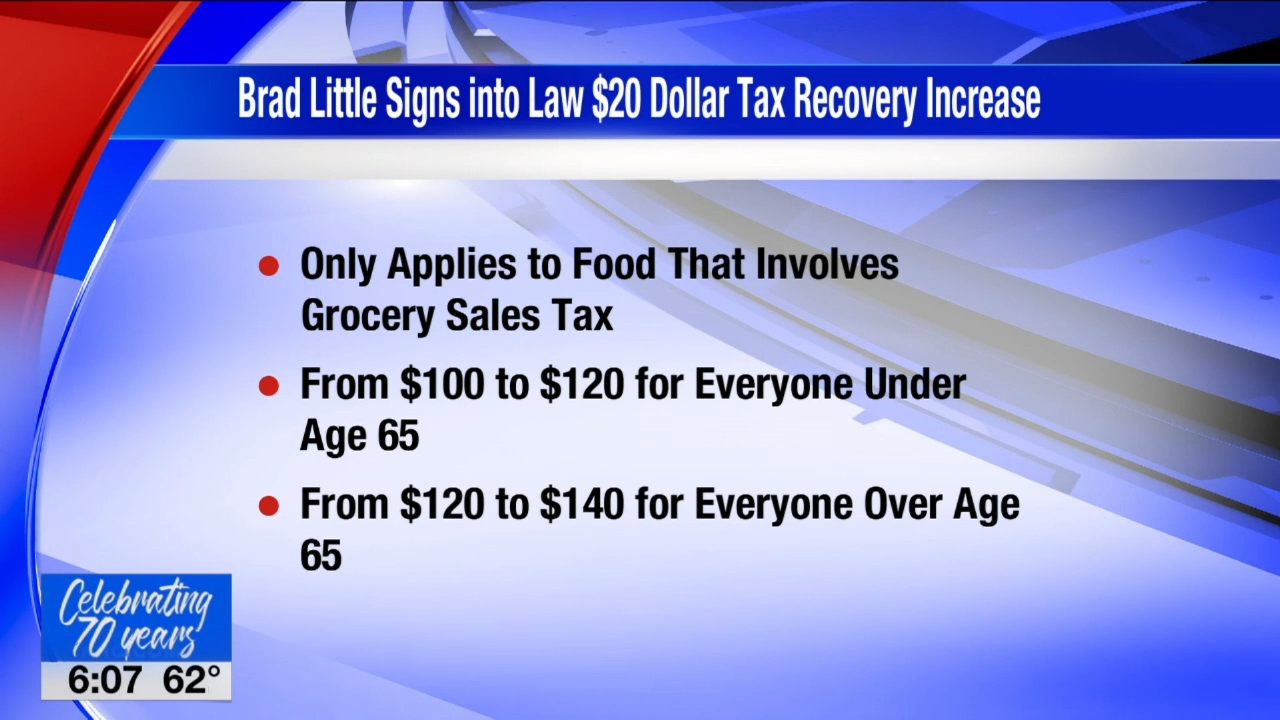

At the election of the taxpayer there shall be allowed subject to the applicable limitations provided herein as a credit against the income tax imposed by chapter 30 title 63 Idaho Code an amount equal to fifty percent 50 of the aggregate amount of charitable contributions made by such taxpayer during the year to a. Otto Kitsinger for Idaho Capital Sun After a long debate Thursday the Idaho House of Representatives passed a bill that would increase the tax credit for groceries Idahoans receive by 20. State requirements include that all students.

A qualified educational entity includes the following. 2021 Meeting Dates Agendas Minutes. 50 of your Idaho tax.

Idaho State Tax Savings 7 19 37 74 Idaho Tax Credit 50 125 250 500 Total Savings for the Year 82 207 412 824 Your actual cost of the gift 18 43 88 176 Idaho Individuals may take up to 50 of a gift up to 1000 a tax credit of up to 500. Idaho Education Tax Credit. Contact your local college or university to see if this program is offered in your area.

Idaho employers also benefit from tax incentives with a 20 state tax credit given for direct contributions to their employees IDeal accounts. Using non-Idaho CE for Idaho license renewal. Withdrawals are limited to tuition payments up to 10000 per year per student.

Submit a Licensee Request for CE Credit form at least 60 days prior to your Idaho license renewal date. At the election of the taxpayer there shall be allowed subject to the applicable limitations provided herein as a credit against the income tax imposed by chapter 30 title 63 Idaho Code an amount equal to fifty percent 50 of the aggregate amount of charitable. Electricty Kilowatt Hour Tax.

Idahos surplus is the highest its ever been 19 billion and counting which represents 40-percent of the General Fund. And libraries and museums qualify for the tax credit if they are located in Idaho. The two core priorities for Idaho throughout this school year are addressing the academic impact of lost instructional time and the challenges to student staff and community wellbeing created by COVID-19.

500 1000 if Married Filing Jointly Your Idaho tax minus the amount of credit for income tax paid to other states. Income tax credit for charitable contributions Limitation. Education Tax Credit Dec 29 2010.

Details on how to only prepare and print a Idaho 2021 Tax Return. The credit is limited to the smallest of the following. Dual credit sometimes called concurrent enrollment is course work in which a secondary student is enrolled in a college level course which is also counted as a secondary course for high school graduation purposes.

2021 Check for updates Other versions. For those who do itemize a donation to the U of I allows income tax deductions on both your state and federal returns. HB 630 temporarily adds the Idaho Commission of.

Unlike most traditional investments an IDeal account can grow tax-deferred. One-half of the amount donated. It doesnt have to cost a lot to make a big difference at Bishop Kelly.

Fuels Taxes and Fees. December 29 2021 By Cascade Library Staff. Governor Little proposes paying off state building debt clearing out one-third of backlogged repairs in infrastructure and bringing rainy-day funds to a.

In Idaho for youth rehabilitation programs like Idaho Youth Ranch there is a 50 tax credit for donations up to 400 if you file a joint return. Courses must fit within Rule 402 approved topics for CE and must relate to. For example if you give a 400 donation to Idaho Youth Ranch and your Idaho state tax bill is 1000 you could be.

Idaho has a unique tax credit opportunity specifically for contributions to schools. As an Idaho tax payer your donations to the University of Idaho and the College of Law may be eligible for a 50 percent education tax credit. 50 of tax on line 42 of form 43.

If passed into law the bill would increase the credit from 100 to 120 and up to 140 for seniors. Idaho Education Tax Credit. Certain room and board costs.

The House in session at the Idaho Capitol on April 6 2021. Idaho Education Tax Credit Home. Idaho individuals may take up to 50 of a gift of.

Below are forms for prior Tax Years starting with 2020. The property must have a useful life of three years or more and be property that youre allowed to depreciate or amortize. And we continue our focus on improving literacy for our youngest students and preparing older students for careers.

Long Ballot Title An Initiative Relating To Education And Taxation. Even better you dont have to itemize your taxes to claim the tax credit.

How Do K 12 Education Tax Credits And Deductions Work Edchoice

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes East Idaho News

How Much Is Your Rebate New Idaho Law Will Give 600 Million In Income Tax Cuts East Idaho News

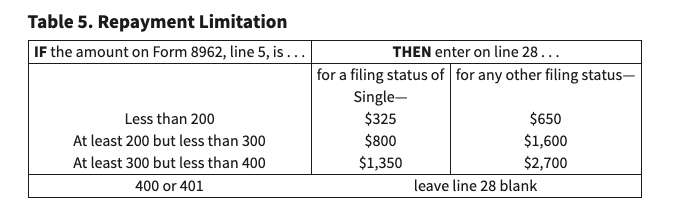

Advanced Tax Credit Repayment Limits

Idaho Residents Start Seeing Tax Relief Money

State Of Idaho Projecting Another Record Budget Surplus As Legislature Prepares To Return Idaho Capital Sun

Idaho Receiving 5 6 Billion Through Arpa Now The Hard Work Begins Idaho Reports

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Idaho State Senator Floats Plan That Would Eliminate School Supplemental Levies Idaho Capital Sun

Idaho Governor Signs Grocery Sales Tax Credit Boost Idaho News Khq Com

Idaho Residents To See Tax Relief Money As Soon As Next Week East Idaho News

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News